Cheyenne Federal Credit Union: Trusted Financial Solutions for Your Needs

Why Signing Up With a Federal Credit History Union Is a Smart Selection

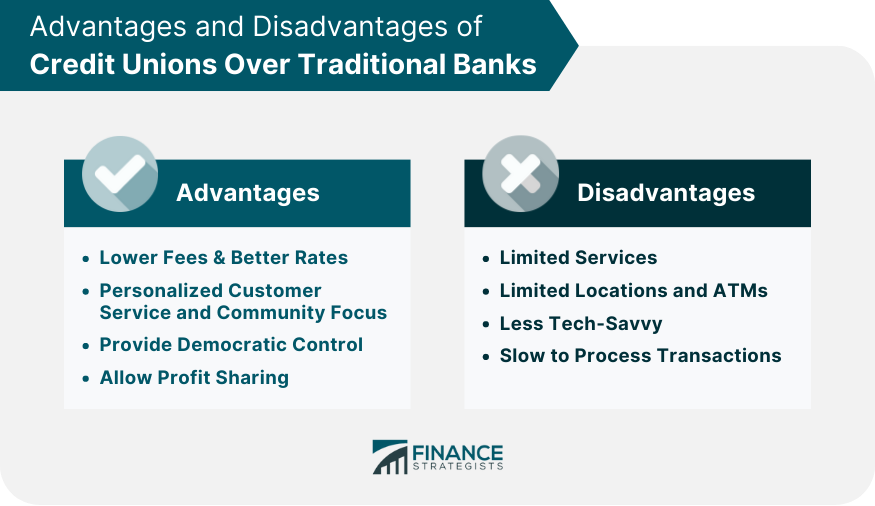

Signing Up With a Federal Debt Union represents a tactical monetary step with various advantages that satisfy people seeking a more community-oriented and tailored financial experience. The allure of reduced fees, competitive rates, and exceptional customer solution sets credit scores unions apart in the monetary landscape. Past these advantages lies a deeper commitment to member contentment and community support that sets them apart. By discovering the unique offerings of Federal Credit rating Unions, people can take advantage of a world of monetary empowerment and link that exceeds traditional financial solutions.

Reduced Fees and Competitive Rates

By focusing on the economic wellness of their participants, credit score unions can supply higher interest prices on financial savings products, aiding individuals grow their cash faster. On the borrowing side, credit report unions tend to have reduced interest prices on car loans, consisting of mortgages, car loans, and personal fundings, making it much more inexpensive for participants to access credit history when needed.

Concentrate On Participant Satisfaction

Federal cooperative credit union focus on participant contentment by tailoring their monetary services and products to meet the one-of-a-kind requirements and choices of their participants. Unlike conventional financial institutions, federal credit report unions run as not-for-profit companies, allowing them to concentrate on providing superb service to their participants as opposed to maximizing revenues. This member-centric strategy is apparent in the individualized focus members obtain when they engage with credit history union personnel. Whether it's opening up a new account, getting a financing, or seeking economic recommendations, participants can anticipate conscientious and supportive solution that aims to address their private economic goals.

By maintaining the ideal rate of interests of their participants at heart, credit scores unions develop an extra favorable and rewarding financial experience. By choosing to join a government debt union, individuals can benefit from an economic organization that really cares regarding their well-being and monetary success.

Community-Oriented Approach

Highlighting area involvement and local effect, government lending institution show a dedication to offering the requirements of their surrounding communities. Unlike typical banks, government credit rating unions run as not-for-profit companies, enabling them to concentrate on profiting their members and neighborhoods as opposed to making best use of revenues. This community-oriented technique is noticeable in different aspects of their procedures.

Federal credit scores unions often focus on using economic solutions tailored to the particular demands of the neighborhood community. By comprehending the distinct difficulties and chances existing in the areas they offer, these lending institution can provide more accessible and individualized economic solutions. This targeted method cultivates a sense of belonging and count on among neighborhood participants, enhancing the bond in between the cooperative credit union and its components.

Additionally, government lending institution regularly participate in community growth initiatives, such as sustaining regional organizations, funding events, and advertising financial literacy programs. These efforts not only contribute to the economic development and stability of the neighborhood but additionally show the lending institution's commitment to making a positive impact past simply monetary services. By actively getting involved in community-oriented tasks, government lending institution develop themselves as columns of assistance and advocacy within their neighborhoods.

Accessibility to Financial Education And Learning

With a focus on encouraging participants with important economic knowledge and abilities, government lending institution prioritize supplying available and useful content detailed financial education and learning programs. These programs are developed to gear up participants with the tools they need to make enlightened decisions about their funds, such as budgeting, conserving, investing, and credit monitoring. By using workshops, workshops, on-line sources, and individually therapy, government credit unions ensure that their participants have accessibility to a variety of educational possibilities.

Financial education is critical in helping individuals navigate the complexities of personal financing and accomplish their long-term financial goals. Federal lending institution understand the importance of monetary literacy in promoting monetary wellness and stability amongst their members. By providing these academic resources, they equip individuals to take control of their economic futures and construct a strong structure for financial success.

Boosted Consumer Solution

Participants of federal credit rating unions often experience a greater degree of individualized service, as these institutions focus on individualized attention and assistance. Whether it's assisting with account management, offering monetary suggestions, or attending to concerns immediately, federal credit scores unions make every effort to go beyond member expectations.

One secret facet of boosted client solution in government lending institution Wyoming Federal Credit Union is the focus on building lasting relationships with participants. By making the effort to comprehend participants' financial objectives and providing tailored remedies, lending institution can provide purposeful support that surpasses transactional communications. In addition, federal credit score unions typically have a solid area focus, additional improving the degree of customer care by promoting a sense of belonging and connection among participants.

Final Thought

In conclusion, signing up with a Federal Lending institution uses countless advantages such click resources as lower charges, affordable prices, tailored solution, and accessibility to financial education and learning (Credit Unions Cheyenne WY). With a concentrate on participant fulfillment and area interaction, credit unions focus on the economic health of their participants. By selecting to be part of a Federal Credit report Union, individuals can delight in a customer-centric approach to financial that promotes strong neighborhood links and encourages them to make educated financial decisions

On the borrowing side, credit report unions often tend to have reduced passion prices on fundings, consisting of home mortgages, automobile lendings, and individual lendings, making it extra economical for participants to gain access to credit when needed.Federal credit score unions prioritize participant fulfillment by customizing their economic items and services to meet the special needs and choices of their members.With an emphasis on empowering members with crucial financial expertise and skills, government credit unions focus on supplying easily accessible and detailed economic education programs. Federal credit score unions understand the value of financial proficiency in advertising economic health and security amongst their members. With an emphasis on member fulfillment and area engagement, credit report unions prioritize the financial wellness of their participants.